Demand for telehealth solutions has boomed over the past few years. Medicare telehealth visits alone grew from 840,000 in 2019 to 52.7 million in 2020, or 63-fold as shown right (source: Benesch Friedlander Coplan & Aronoff).

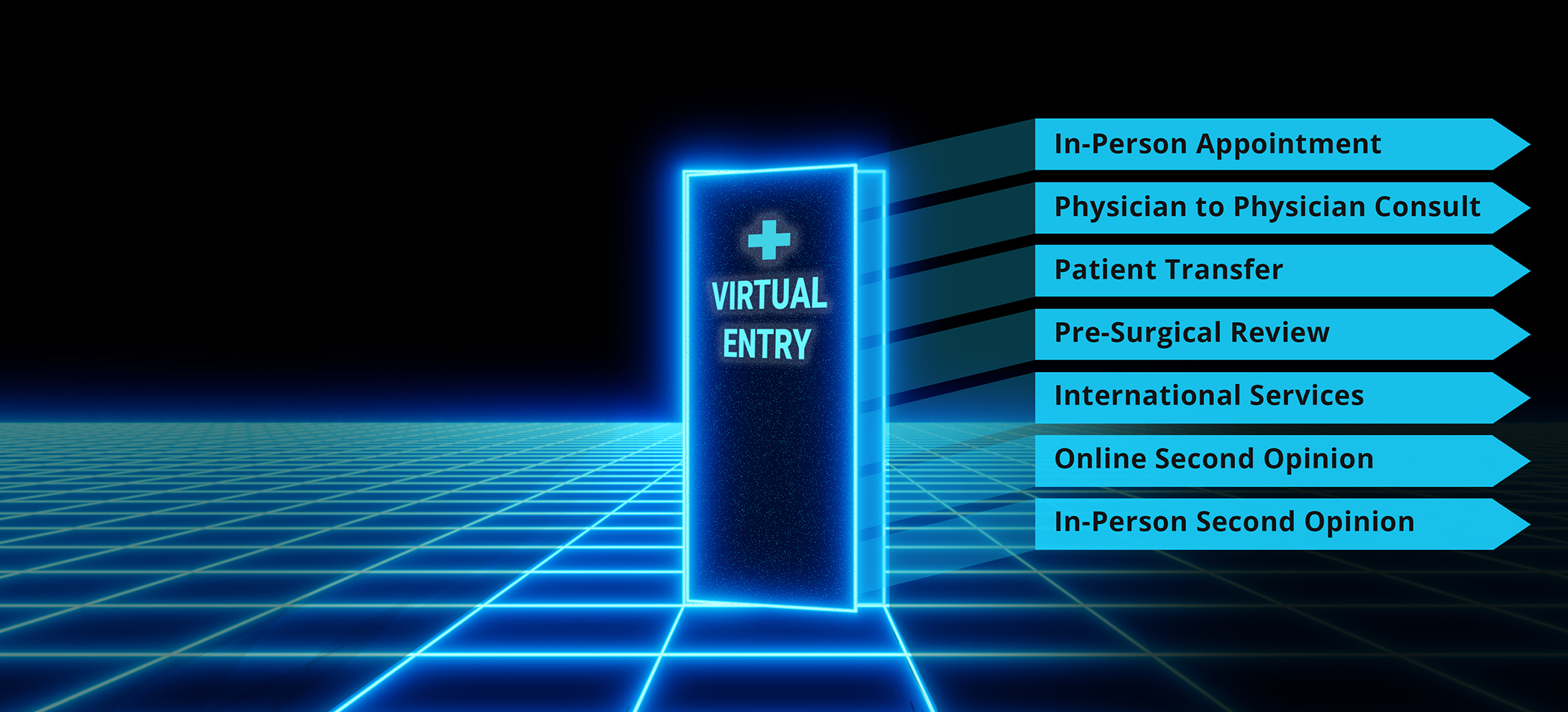

For cases deemed appropriate for telehealth, some studies have provided overwhelming evidence of increased patient satisfaction with remote visits compared to traditional in-person (urology; breast cancer; radiation oncology; general medicine). One of the main drivers? Convenience. Patients love removing the travel time and associated costs or tradeoffs that come with taking off work, finding childcare, and traveling to see a physician in person. Additionally, the CDC reports that 15%, or 49.8 million Americans live in rural parts of the U.S., which correlates with poorer health outcomes regardless of income level. Access to specialty carefor this population has been known to be especially difficult or impossible, but telehealth programs have introduced a new channel that many patients can take advantage of.

In addition to increasing patient demand, there is a strong business case for Hospitals to expand their reach through telehealth modalities. A recent article by Purview's Dr. Christopher Schwartz, Remote Second Opinions: A Cure for the C-Suite Blues, describes the challenging financial state of many hospitals post-covid. Schwartz explains that, ‘during the lockdown alone, U.S. hospitalslost an estimated $22 billion in revenue due to cancellations in elective surgeries.’ Contrast this with the estimated value and market growth of the second opinion market at $10.7 billion by 2027with a CAGR 16.8%, and it is understandable why many hospitals are exploring the potential of these programs. Here, we outline key considerations for your organization as you assess readiness prior to launching a second opinion program.